With the recent expiry of the first Polkadot parachain lease periods and the unlocking of a large amount of DOT, over 3.3 Million DOT have been minted into Bifrost’s liquid staking solution for staked DOT - vDOT, with a total value reaching 18 million USD.

The Polkadot Unlock Harvest campaign incentivizes users to mint vDOT with their DOT. Users receive points, Raindrops, for each vDOT minted. More specifically, users receive primary DOT staking rewards and a share of the bonus pool of 500,000 BNC - worth over $150,000.

The percentage of rewards a user gets depends on the number of raindrops they have accumulated.

The campaign started on October 24th and will run until November 22nd.

For detailed rules, please refer to the article: “Polkadot Unlock Harvest - Rules and Rewards of the upcoming Bifrost Event”.

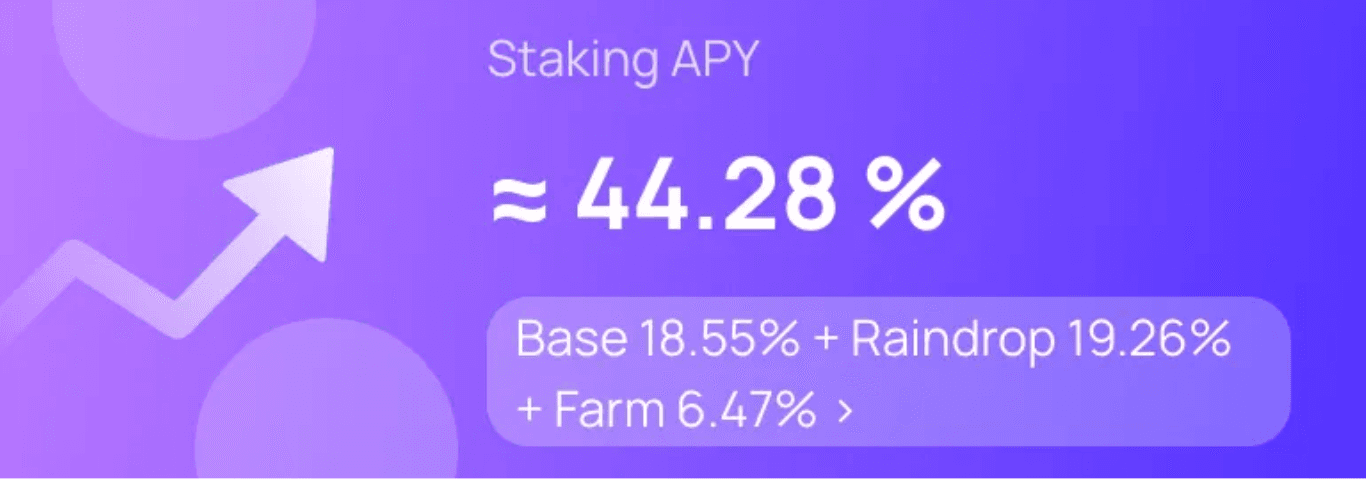

Bifrost offers users a competitive earning APY for staked DOT through dynamic validator selection and also offers users more ways to maximize their capital efficiently with compelling use-cases throughout the Polkadot ecosystem.

The sum of the basic yield of staking (Base), combined with the expected yield from the Polkadot Unlock Harvest event’s prize pool (Raindrop) and the vDOT/DOT Farming pool, results in a comprehensive annualized yield of vDOT currently exceeding 44%!

Why choose vDOT?

As a liquid staking token (LST) for staked DOT, vDOT has the following advantages:

- The first LST to retain governance rights of the original chain: vDOT supports Polkadot OpenGov and reserves the voting rights of the staked DOT. vDOT users can have their say in the governance of Polkadot as they would with DOT and obtain underlying staking yield, straight through the Bifrost interface.

- Instant Withdrawal: While users can redeem vDOT for DOT at any time through the Swap pool without waiting for the 28 days unlock period, the Fast Redeem feature allows users redeem their vDOT for DOT in less than 28 days via the matching queue mechanism.

- Yield bearing Asset: Staking rewards increase the value of vDOT relative to DOT, reflecting in the continuous growth of the redemption rate of vDOT to DOT. Users do not need to claim Staking rewards manually.

- Security and Decentralization: Bifrost is a decentralized, non-custodial protocol. Bifrost maintains the diversity of validator delegation through its automated and dynamic algorithm, avoiding centralization risks.

- Slash Protection: Bifrost protects users from slash losses through the BNC Insurance Fund. When a slash loss occurs, funds from the insurance fund are used to compensate first without affecting user earnings.

- Multiple Use Cases: vDOT is used in various DeFi applications, such as liquidity farming on DEXs, restaking and as a collateral asset on lending and borrowing protocols.

vDOT use-cases

- Providing liquidity on the DOT-vDOT pair on native DEXs on the Astar network with Arthswap, and on Moonbeam network with Beamswap, and Stellaswap. Users provide liquidity and earn liquidity rewards.

- vDOT can be collateralized and lent out on the Interlay lending market, allowing users to implement a yield-farming strategy to achieve a higher compounded yield. However, this strategy requires risk management, as increasing the number of cycles may lead to higher liquidation risk. Alternatively, users can lend out vDOT to earn interest without engaging in additional borrowing.

- vDOT can be used as collateral for iBTC vaults, enabling vault operators to access staking rewards whilst securing the trustless iBTC bridge.

- vDOT can be used for participating in Polkadot governance. For users who stake DOT to mint vDOT, governance rights remain in their hands. This also reflects the Bifrost protocol’s neutrality in governance.

Conclusion

Since its development, the liquid staking sector has evolved from a competition based solely on yield rates to a dual of yield rates and ecosystem application scenarios.

Due to Bifrost’s unique cross-chain architecture, vDOT holders have a flexible and secure solution providing optimal staking yield and benefit from interoperable and composable use cases across ecosystems.

Finally, vDOT is the only LST allowing holders to participate in Polkadot governance while earning their staking yield. It is a compelling solution for users who face the dilemma of whether to stake, participate in DeFi, and govern.

If you are holding DOT, are you still sure you don’t wanna try vDOT?